The Price of Losing Autonomy

Assessing the Economic Impact of County-to-district Mergers in China

Jianzi He (Fudan University)

Amalgamations have gained popularity worldwide as important strategies for enhancing administrative efficiency and addressing a variety of governance challenges, including fiscal constraints, demographic shrinkage, and fragmented urban governance. This trend has also spurred a surge in empirical research to assess the actual impacts of such territorial reforms across diverse political and social contexts. One noticeable pattern that emerges from the literature is that small and politically marginalized units are often underserved after amalgamations, as a result of their diminished political importance in the post-amalgamated jurisdictions.

This article, entitled “The Price of Losing Autonomy: Assessing the Economic Impact of County-to-district Mergers in China,” extends the discussion of such uneven impacts of amalgamations to the context of county-to-district mergers in urban China. In these mergers, Chinese city governments convert county-level units, previously under their jurisdictional supervision, into subordinate districts under more direct territorial and administrative control. While the administrative hierarchy distinguishes county-to-district mergers in China from amalgamations in many other countries where merger partners are typically more politically equal, the distinctive center-periphery relationship between cities and city-level units in China provides a valuable empirical context for exploring the distributive impacts of amalgamations on the politically weaker side.

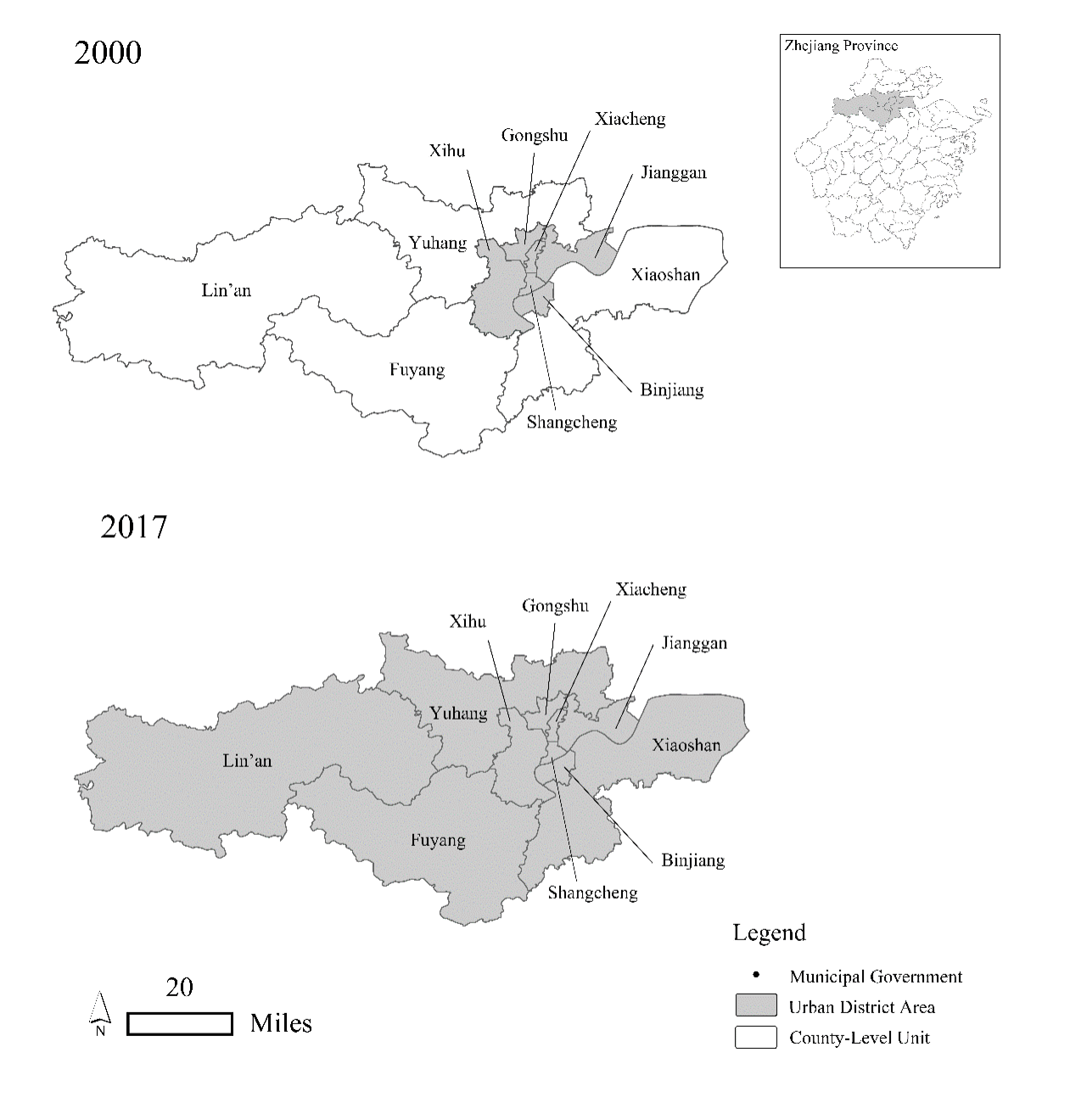

Figure 1. Changing district configuration of Hangzhou city (2000-2017) as the result of county-to-district mergers

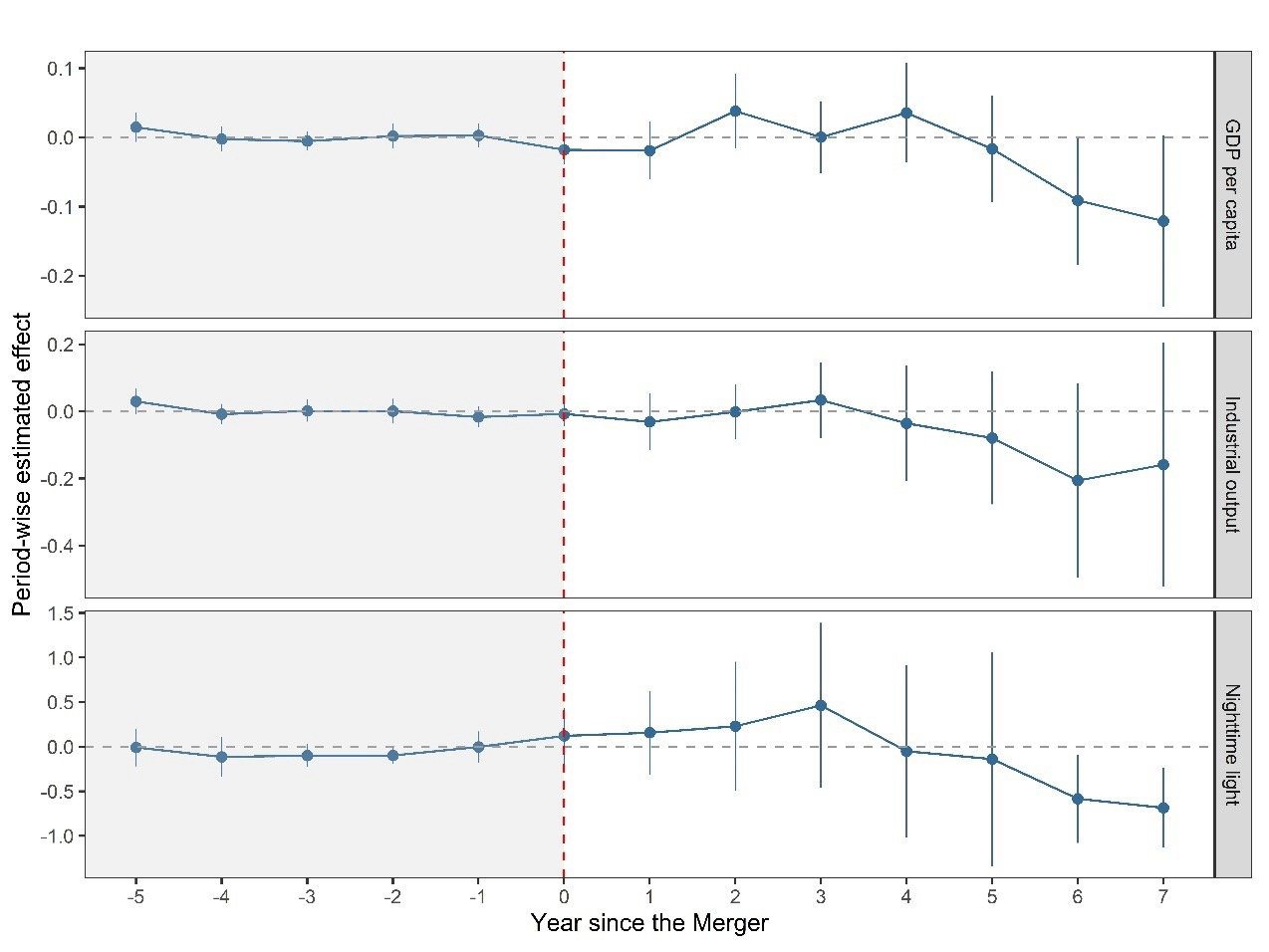

Drawing on a panel dataset of 2,328 Chinese county-level units spanning from 2000 to 2019, the article employs an interactive fixed effects counterfactual estimator, a state-of-art method causal identification method in panel data settings to assess the economic impact of county-to-district mergers. The quantitative analysis reveals a generally less optimistic outlook on the economic consequences of county-to-district mergers for these county-turned-districts. Concerning microeconomic indicators specifically, per capita residents’ savings deposits and the average wage level exhibit a significant negative impact in the initial post-merger years. As for macroeconomic indicators such as GDP per capita and nighttime light luminosity, their values do not immediately decline in the early post-merger years. However, starting from the fourth or fifth year onwards, these variables also begin a downward trajectory, with negative and statistically significant estimates appearing in some later years. This implies that county-to-district mergers initially exert a negative impact at the micro level, presumably by affecting depositors and enterprises providing well-paid jobs and subsequently result in negative long-term macroeconomic prospects.

Furthermore, mergers have exerted a negative and significant impact on a greater number of outcome variables in provinces where most counties were previously directly supervised by cities compared to those where provinces once supervised counties and therefore provides the latter with more bargaining power vis-à-vis cities. This indicates that the power dynamics between cities and county-level units play a crucial role in shaping the effects of mergers, with the political leverage held by counties influencing the extent to which they are negatively affected in the merger process.

Figure 2. The summary of period-wise estimated effect of merger on the three macroeconomic outcomes variables

To further examine the role of administrative autonomy, this article explores three county-turned-districts in Hangzhou city as an ancillary comparative case study. Among the three districts, Xiaoshan and Yuhang districts were originally supervised by the provincial government of Zhejiang and therefore successfully retain most of their administrative autonomy even after being merged as districts. By comparison, Fuyang district came under the direct control of Hangzhou soon after the merger. As expected, when comparing the annual economic statistics of these units against other counties within the jurisdiction of Hangzhou, Xiaoshan and Yuhang do not exhibit any signs of negative impacts in the economic outcome variables after the mergers. In contrast, Fuyang, which lost administrative autonomy following the merger, did exhibit a slowdown relative to its peers. Taken together, the findings highlight the importance of administrative autonomy in explaining why county-to-district mergers tend to negatively impact county-level units in China.

This article builds on existing literature to show a consistent empirical pattern that politically disadvantaged units tend to become the victim of amalgamations in both democratic and authoritarian systems. From a policy perspective, the findings serve as cautionary reminders for amalgamation reforms that aim to incorporate small cities with a vibrant economy into larger metropolitan areas to pursue greater scale economies. In addition, the article sheds light on the loss of administrative autonomy as an important mechanism that leads to the negative economic impact of mergers. Future empirical investigations can build upon this finding to further explore the determinants for heterogenous merger outcomes across merger partners and trace this causal process in greater depth.

Figure 3. The summary of period-wise estimated effect of merger on the three microeconomic outcomes variables

Jianzi He is currently an assistant professor at Fudan University's Institute for Global Public Policy, as well as a faculty affiliate of the LSE-Fudan Research Centre for Global Public Policy. He studies political economy, regional and urban governance, and Chinese politics.